Could you see a cash loan with a Debit credit?

Having to pay with earnings is similar to utilising the bathroom. Whenever you gotta exercise, you gotta do it. And while cash-only purchases might not be as usual today into the ages of your Venmos along with your Paypals, it’s still one thing you will experience from time to time.

Even if you you should not carry funds around on the routine, any lightweight earnings deal tends to be managed fairly effortlessly. You can just visit your local Automatic Teller Machine and make a withdrawal, or you can take in to the shop and obtain money back.

However, if you will need to render a bigger money transaction-like purchasing an used car-then you’re going to have to change in other places. You’ll probably have to take completely a cash advance on your own debit card. Not familiar with how that actually works? No worries. That is what we’re here for.

Yes, you need the debit card for a cash loan.

Whenever you envision a€?cash advancea€?, you are probably considering credit cards cash loan. This is where you take down cash utilizing your bank card, together with quantity you withdraw is put into your own total stability. (You can read our total help guide to cash advances inside the OppU post Understanding a Cash Advance?)

A debit cards advance loan is significantly diffent. In the place of adding resources to a revolving balances, a debit cards advance loan withdraws that cash right from your own checking account. With regards to where in fact the revenue originates from, a debit credit cash advance is precisely exactly like taking out money from the ATM.

To take out a debit credit cash advance, all you need to create is go to a local lender or credit score rating union department and speak to a teller. There’ll be a payment for requesting the  advance, generally some tiny amount associated with the full quantity taken.

advance, generally some tiny amount associated with the full quantity taken.

What’s the aim of a debit card cash loan?

If taking out a debit credit cash advance is simply the exact same thing as taking out funds from the Automatic Teller Machine, after that what’s the point? Really, there are many various main reasons taking out fully a cash advance on a debit credit is advantageous:

1. They show up with higher limits: If you have ever tried to take-out serious cash from your own Automatic Teller Machine, no doubt you’ve encounter difficulty: there is a daily maximum about how much it is possible to withdraw. For regular ol’ checking accounts, it is usually somewhere within $300 to $500. But with a cash advance, the limitation would be a great deal higher-in the thousands of dollars, maybe not the lots.

2. you can make use of more finance companies: Most of the time, possible head to any nearby lender branch and acquire a debit credit cash loan, even when it isn’t associated with the bank. In the event that you bank through a credit union, this may largely end up being the together with other credit unions also. Not being limited by your own bank is an enormous positive aspect. Although it ought to be mentioned not all banking companies encourage your own ask for a cash advance. Consult with your lender for details.

3. they don’t really carry interest: When you take-out an advance loan in your mastercard, you are getting billed more than just a charge; you are getting billed interest, too. And that rate of interest does not only getting more than the rate for your standard deals, it will also skip the one-month elegance course. That interest begins accruing straight away. Conversely, debit credit cash advances you shouldn’t include any interest, simply the first charge. That produces them a much more affordable choice for smooth earnings!

Exactly what are the drawbacks to a debit credit cash advance?

The largest downside is it: you cannot take-out a cash loan on a debit credit for over you may have within bank checking account. Often, when individuals wanted disaster finances, it’s because they do not have the cash duration to pay for an unforeseen costs. In cases like this, a debit credit cash loan is not planning to would all of them a great deal good.

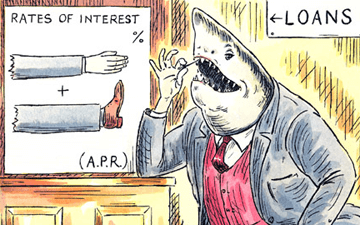

Today, maybe you are in a position to move a cash loan which is bigger than the bank account stability, but performing this ways overdrafting, and overdrafting ways coping with some pretty sizeable charge. Per a study through the customers economic security agency (CFPB), the common overdraft cost works out to an annual amount rates (APR) more than 17,000per cent.

In conclusion, the simplest way to deal with unforeseen expenditures is need an emergency fund-cash that can be found for you to use any time.