Option to Pay Day Loans: Self-reliant Selection

Payday advances and temporary installment debts victimize the urgent need of everyone for small-dollar quantities and cost extremely high costs and interest into the borrowers. PayActiv has continued to develop a fintech option, a proper alternative to payday advances that can help average applied folk stay away from these debt-traps of predatory lending and become self-reliant in controlling their particular costs.

Lately, condition and federal rules being passed to manage the payday loan field being protect consumers through the deceptive procedures of lenders. Despite that, responding for the opposition of single-payment loans, the lenders need released an off-shoot of payday advance loan called temporary installment financing, which allow consumers to settle the financing over 6 months or lengthier, but the average borrower nonetheless ultimately ends up spending two to three times of the lent quantity.

Requirement for small-dollar financial loans

Estimated 40per cent of society that either unbanked or underbanked (25% of U.S. household) use through small-dollar loans, rent-to-own contracts, pawn shops, or refund anticipation financing (FDIC, 2009). Also, hundreds of thousands in middle-class, with minimum benefit and just have maxed completely their own credit cards, also check out small-dollar financial loans in times during the demand.

The typical main reasons why family use credit score rating or financing for fundamental expenditures are because either their own costs meet or exceed their own earnings, or surprise expense happens like a vehicle digest or higher frequently due to the mismatch in time regarding spending and earnings. Folks are settled every two weeks but lives occurs on a daily basis.

Research has revealed your borrowed cash is used to pay for fundamental expenditures such spending bills, as well as clothes expenses, vehicle maintenance, or home repairs. Not only that, most customers of small-dollar debts in addition document getting steps to reduce using and going without some elementary desires (CFSI Levy and Sledge, 2012).

When facing cost due dates, for an individual who willnot have credit cards the only payday options have already been to cover overdraft lender cost if their unique inspections you shouldn’t obvious or perhaps to defer spending expenses of the due date, which results in extra charges like later part of the fees and solution recovery or reactivation cost. These fees, which we phone fee-traps, can add up to $100 on a monthly basis for a low-wage staff member.

Pay day loans include small-dollar credit score rating contrary to the potential revenue in type of a salary. The lender takes sometimes a finalized check from borrower, that your loan provider cashes at the time of subsequent paycheck or even the lender usually takes the bank checking account information through the borrower for a direct detachment from the account on payday.

The average size of these financial loans try $350 and the fee or interest recharged because of the lender typically range from $15 to $30 per $100 lent for payday loans Oregon about a two-week stage. At $15 per $100, for a $350 loan, the borrower needs to pay off $402.5 in 14 days.

In the event that financing is certainly not repaid the complete quantity then it is rolling over until further wages cycle with further charge at $15 per $100 of balances.

CFSI estimates that an average of a debtor removes eight loans of $375 each every year and uses $520 on interest.

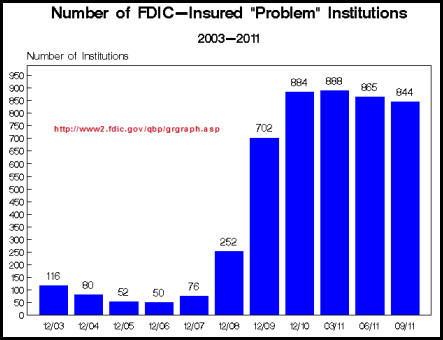

Whilst federal agencies, CFPB*, has been trying to manage the single-payment small-dollar credit industry, the small-dollar installment credit has become growing since 2011, & most payday lenders allow us installment loan items.

Installment financing have actually big major amount and enable half a year or even more to pay for back lightweight installments. Even though it is convenient that payback is within little installments but the interest could add to several times the initial key.

The average installment loan is $1200 to be reimbursed in 13 installments at 300per cent APR, utilizing the debtor trying to repay around $3000 in 6.5 months.

Which utilizes small-dollar payday loans

In spite of the challenging terms and conditions ready up against the debtor, whenever confronted with an urgent situation people that would not have usage of other designs of credit score rating move to small-dollar loans.

a loans complimentary substitute for pay day loans

PayActiv keeps conceived a FinTech answer to create professional a substitute for payday advance loan as well as other small-dollar debts. Weekly over $100 billion are obtained but remains unpaid because of inefficiencies from the financial systems. Whenever you enhance it the excess lag of just one week in payroll cut-offs, the amount is readily over $200 billion. This money is caught within the program waiting to see disbursed to the scores of staff members who will be juggling insidious later part of the charge and overdraft charge to get by.

PayActiv economic providers solve the tiny money dependence on issues and cash droughts by providing entry to these accumulated but delinquent earnings. Helping staff members stay away from punishment recently repayments or needing to get predatory loans to get over her situation.

How does they function? PayActiv is offered as a worker profit

PayActiv emerges as a voluntary benefit by companies, which means that staff can enroll and employ our solutions once its granted as a benefit by the employer.

Company agrees to offer PayActiv as a benefit. It is a turnkey remedy, no integration is necessary because of the boss even as we leverage the current payroll and time/attendance system. The highest security guidelines is adopted.

Personnel on-boarding uses an easy one-click system on SMS, PayActiv mobile app or website. And all of financial services include quickly open to the staff.

How PayActiv facilitate employees with lightweight money wants?

Workforce can access up to $500 of their accumulated but outstanding earnings to deal with her expenses without the concern with late charge, borrowing from pals or using predatory financing. Employees shell out $0 to $5 according to company and just whenever funds were reached. There is no various other cost.

Resources for emergencies is only the start, PayActiv boasts a revolutionary allowance and savings device to greatly help workers policy for future, plus no-cost monetary services to pay debts using the internet, create lender transfers, and earn benefits.

How can PayActiv let companies?

PayActiv assists create an effective and engaged employees. Because, whenever companies show they care about the true issues regarding workers, they create confidence and engagement using their employees. Learn more about the business enterprise discount.

How to start off

If you are an employer and into providing a genuine alternative to payday advances for your workforce, we can install it as quickly as twenty four hours since it doesn’t need any adjustment towards hour, payroll or IT programs. Call us to get started or get more records, we will be pleased to reply to your inquiries.

* The CFPB affirmation Order relates and then Payactiv’s Payroll Deduction EWA products and never to all the Payactiv services or products. The acceptance Order are a public data, and will be assessed right here.