Payday Advance Loan Are Pricey

An incredible number of People in the us turn-to payday advance loan each year and then discover they may be an extremely expensive way to get quick cash.

Regardless they are labeled as a payday advances, cash advance payday loans, or deferred deposit debts apeople become experiencing costs that translate to interest rates which range from 200percent to significantly more than 500percent.

People that check-out payday financing companies in storefronts or on the web frequently require revenue easily to allow them to settle payments starting from vehicle repair works to rent.

But there is a big catch a you’re not allowed to making smaller money regarding the financing until it is paid off a you either pay the quantity or little. And that is where someone get jammed.

Research indicates a lot of people can not afford to repay the entire levels at the end of only two weeks, so they need certainly to keep expanding the loan for more time and always spend additional fees.

A written report because of the Pew Charitable Trusts discover nearly 12 million People in the us take-out payday advance loan each year, which an average pay day loan is not paid down for five period.

If someone else borrows $300 and has to pay for $15 in charges for every $100 borrowed, they’re going to owe $345 at the end of https://worldpaydayloans.com/payday-loans-wy/farson/ week or two. Should they can not afford to pay the total amount borrowed, you have the choice to expand the loan for the next $45 fee every a couple of weeks the mortgage payment is actually extended.

That is certainly when the expenditures can soar. If a debtor pays $45 every two weeks for 5 several months, might spend $450 in charge by yourself. That is mortgage of 391% and it is more than the amount of the borrowed funds alone. And still have to payback the first $300. Thus in five several months, that $300 mortgage ends up costing the debtor at utter of $750.

– your best option would be to always expect the unforeseen. Scale back on cost of living whenever we can and put funds into a savings profile. It might be frustrating on a restricted earnings, but even having $500 in emergency economy is a giant support. Planning and after children resources will allow you to read where you could keep your charges down to save money, and certainly will notify you in advance to possible cash-flow trouble.

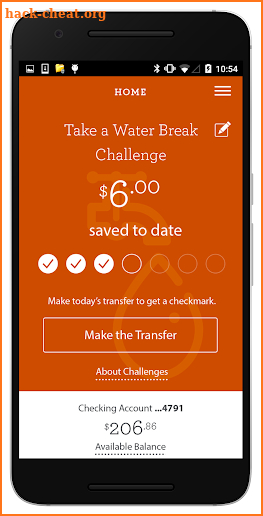

– consult with your standard bank to see if they provide short term lightweight debts. If so, the rate of interest they demand shall be far below a payday lender, and you will certainly be capable of making installment payments without being forced to payback the complete amount at the same time.

– test calling your creditors to inquire about if they provides you with more time to pay the expenses. You could be obligated to spend a late-payment cost, however it shall be far below cash advance expenses.

– when you yourself have a charge card as well as haven’t hit your restrict, you will consider using they right after which producing money eventually.

– Should you appear to be stuck with debt and need help doing exercises payment tactics or generating a budget, try getting in touch with a non-profit consumer credit counseling solution to see if they have no-cost or low-cost aid that could work for you.

Considerably in Personal Loans

- Trying To Repay Student Education Loans?

- Think Carefully Before Selecting Lease Your Can Purchase

- Items You Should Know About Student Education Loans

- Have Your Important Income Tax Info Ready and Organized

- FDIC Insurance Rates Shields Your Money Deposits

- Teach Your Kids The Significance Of Spending Less

|